Welcome to Issue #2

"Golf is the closest game to the game we call life. You get bad breaks from good shots; you get good breaks from bad shots - but you have to play the ball where it lies"

Bobby Jones

What’s on our mind this week

Edoardo Molinari showing plenty of ‘charisma’, Xander reigns in his motherland, 6 year old golf influencers, paying €35m for a golf club and cancelling all memberships, Jon Rahm going into hibernation, Rory’s dog out of the bag, Tiger’s back.

In the news

Why it matters: The pendulum is swinging back. The Financial Times reported that social media usage peaked in 2022 and has declined steadily since, with adults spending 10% less time on platforms than three years ago. The sharpest drop? Ages 16-24.

Our Take: This cultural shift presents a great opportunity for brands that create real-life experiences. People are seeking out authentic, offline connections which golf happens to have in spades. This news makes us excited for the future of golf.

Why it matters: Malbon Golf's $28 million raise proves investors are betting big on golf's cultural shift. The brand shows golf apparel can embrace streetwear aesthetics and command premium prices. Jason Day ditching Nike for Malbon is the ultimate validation.

Our Take: Malbon's raise highlights that golf culture is changing and that investors are willing to take a punt that this will be a long-term play and not just a short-term trend. Traditional brands haven’t survived decades by accident, they understand that the balance between fashion and function is where golfers feel most comfortable however Malbon is betting that a new wave of consumers now see golf apparel as lifestyle branding first, function second. Time will tell if that bet pays off.

Why it matters: The NGF's 2025 Top 100 Businesses in Golf reveals who's winning in the $100 billion golf industry. Notable newcomers like AboutGolf, Five Iron Golf, Super Stroke, and L.A.B. Golf reflect over 10% turnover from the previous list, driven by M&A activity. The list spans equipment makers, course operators, tech providers, and apparel brands, showing an industry increasingly shaped by innovation, simulation technology, and consumer experiences rather than traditional golf alone.

Our Take: This list shows where investors are placing their bets. When simulation companies and specialty equipment brands replace established players, it signals shifting consumer preferences. The 10% turnover isn't chaos - it's healthy disruption. These businesses are solving real problems and removing barriers, attracting new players and growing the game. There's much to learn from understanding how this 10% earned their spot.

Pic from WWD

Worth your time

Listen: No Laying Up Podcast Great feature on the Korn Ferry Tour broadcast team discussing the 2025 season, the tour championship, and profiles of golfers who've earned PGA Tour cards.

Read: Unreasonable Hospitality Book by Will Bodera. A must-read for all businesses. A fascinating book of lessons about both service and leadership.

Watch: 4 year old sinks hole-in-one This kid does what most golfers never get to experience!

Tech: Loom The best free online screen recording tool. Using this a lot for presentations.

Feature story

Topgolf’s next shot: A look inside the $3.6 billion entertainment brand

Pics from Topgolf

Here's a statistic that should make every golf executive pause: nearly 50% of Topgolf's customers describe themselves as "non-golfers." In an industry that has spent billions trying to attract new participants with limited success, Topgolf somehow made golf irresistible to the very people who've been avoiding it for years. That's not just impressive, it's cultural engineering. But as Topgolf now faces slowing growth and significant financial headwinds, it's learning the uncomfortable truth: disruption doesn't guarantee a sustainable business model.

The Origin: From UK concept to global phenomenon

The Topgolf story began in the UK with twin brothers Steve and Dave Jolliffe, who envisioned transforming the traditional driving range experience. What started as a novel concept quickly evolved when it crossed the Atlantic. Topgolf transformed stale, one-dimensional driving ranges into hybrids of US sports bars, high-energy arcades, and social clubs, all powered by proprietary technology.

Today there are over a 100 Topgolf facilities worldwide, but calling them "driving ranges" completely misses the point.

What Topgolf actually built

In reality, Topgolf is an entertainment business where golf happens to be the hook.

Customers pay by the hour for bay rentals, with dynamic pricing based on time and location, but the real profits come from food, beverage, and corporate events. One executive famously joked that "Topgolf is a restaurant chain cleverly disguised as a driving range," and the numbers back this up. Approximately two-thirds of Topgolf's revenue comes from food, beverage, and corporate events, not from the customers hitting golf balls.

Each venue simultaneously hosts birthday parties, corporate team-building events, casual friend groups, and competitive leagues, all generating multiple revenue streams from the same asset, a retail and hospitality principle brilliantly executed in a golf context.

Why Topgolf has been so successful

Topgolf made golf accessible by removing every traditional barrier. You don't need to know anything about golf, wear specialised footwear, or buy expensive clubs to enjoy the experience. The Toptracer technology gamifies everything, making it "competitive socialising" where every shot counts whether you're trying to outdrive your boss or impress your date.

Topgolf also capitalised on the growing "experience economy" among Gen Z and Millennials, demographics that value experiences over material goods. Step into a Topgolf on a Friday night and the atmosphere resembles a high-energy concert venue or sports bar more than a country club, with music blaring, sports on every TV, beer towers and cocktails flowing.

The Callaway acquisition: betting big on disruption

When Callaway bought Topgolf for $2 billion in 2020, many in the industry questioned the rationale. But Callaway spotted an opportunity: Topgolf was attracting non-golfers en masse, drawing in younger demographics, more families, and more women, segments golf has struggled to reach for decades.

The demographic data made the bet look smart. Nearly 50% of Topgolf customers identified as non-golfers. While only 25% of traditional golfers nationwide are between 18 and 34, this demographic represents 64% of Topgolf's customer base. Over 80% are football fans, proving the venue attracts sports enthusiasts, not just golf purists.

These weren't just encouraging numbers. They represented a fundamental shift in who was engaging with golf.

Pic from Topgolf

The headwinds now facing Topgolf

Then reality set in, and the numbers started telling a different story.

Same-venue sales declined 9% in 2024, and this trend is forecast to continue in 2025. The novelty appears to be wearing thin as customers aren't coming back as frequently as they once did.

The challenges are mounting. New venues cost $15-40 million each, and in a high-interest-rate environment with softer consumer spending, each location must perform consistently for years to justify the investment. Meanwhile, competitors like Drive Shack and Five Iron Golf now offer similar experiences, and upgraded traditional ranges have adopted the technology that once differentiated Topgolf. At $35-60 per person, Topgolf sits squarely in discretionary spending territory, vulnerable when budgets tighten.

The financial strain is real. Parent company Topgolf Callaway Brands saw 2024 revenue fall 1.06% to $4.24 billion, with adjusted EBITDA forecast to drop from $588 million to $415 million. Add leadership upheaval - CEO Artie Starrs departed in October 2025, and the planned Callaway separation announced in February 2025 - and you have significant organisational disruption during a critical period.

Where Topgolf goes from here: three possible futures

Topgolf faces three potential paths forward. The first is optimising existing venues, pausing aggressive expansion (currently 10+ venues per year) and focusing on maximising revenue from the best 60-70 locations through experience innovation and premium upselling.

The second is licensing their technology, shifting from venue expansion to licensing Toptracer to golf courses and driving ranges, an asset-light growth strategy with lower capital requirements.

The third is reinventing the format entirely, developing smaller "Express" venues for suburban locations or experimenting with hybrid entertainment formats blending other sports.

My prediction? If I was a betting man, I'd say Topgolf will combine the first two approaches, optimising existing assets while expanding through technology licensing. Their capital intensity problem demands this approach, and separation from Callaway enables strategies independent of equipment sales.

What the rest of the golf industry can learn

The first lesson is that golf doesn't need a traditional format. Nearly 50% of Topgolf customers are self-identified non-golfers who may never play a traditional round. Traditional operators should view entertainment concepts as entry points, not threats.

Second, technology alone isn't differentiation. Toptracer is now widely available. Topgolf's real edge is the complete experience - social atmosphere, food, vibe, and service. Technology is 20% of the formula; the other 80% is creating a hangout where golf is the excuse but socialising is the purpose.

Third, capital intensity is unforgiving. Before building a $20 million facility, stress-test scenarios like declining sales, elevated interest rates, and recession. Sometimes enhancing existing assets beats building new ones.

Fourth, youth want golf on their terms. 64% of Topgolf customers are ages 18-34. Young people aren't avoiding golf. They're avoiding its barriers, stuffiness, and time commitment. Traditional facilities have an opportunity to experiment with music, relaxed dress codes, and social formats targeting friend groups over serious golfers.

Finally, product-market fit doesn't equal a sustainable business model. Topgolf achieved excellent product-market fit, but that doesn't guarantee profitability with high capital intensity. Test unit economics and payback periods before launching. Enthusiasm isn't a business plan.

Topgolf changed golf forever. What happens next is up to all of us

Here's what I know for certain. Topgolf has already won in the most important way. They demonstrated that golf can be cool, accessible, and wildly popular with demographics our industry desperately needs. They proved that technology can enhance rather than complicate the experience. They showed that removing barriers works better than lowering them.

Whether Topgolf thrives, survives, or struggles over the next few years almost doesn't matter to the broader narrative. They've already changed the conversation. Every golf operator is now asking better questions: How do we attract younger players? How do we make golf more social? How do we reduce intimidation?

For Topgolf itself, the next 18 to 24 months will determine their fate. They need to stabilise same-venue sales because nothing else matters if existing locations keep declining. They need to demonstrate that the business model works at scale, not just during the growth phase.

The challenges are real, the risks are significant, and the competitive environment is intensifying. But I've learned not to bet against concepts that genuinely connect with customers, and Topgolf has that connection.

For the rest of us in the golf business, whether you operate courses, manufacture equipment, run tournaments, or simply love the game, Topgolf's story should inspire and instruct. Be willing to experiment. Be willing to let golf look different than it always has. Be willing to meet customers where they are rather than demanding they come to where golf has always been.

The future of golf isn't traditional courses or entertainment concepts—it's both coexisting. Topgolf changed the conversation. Now the industry must learn from it.

One thing from history

The handshake that created the modern sports business

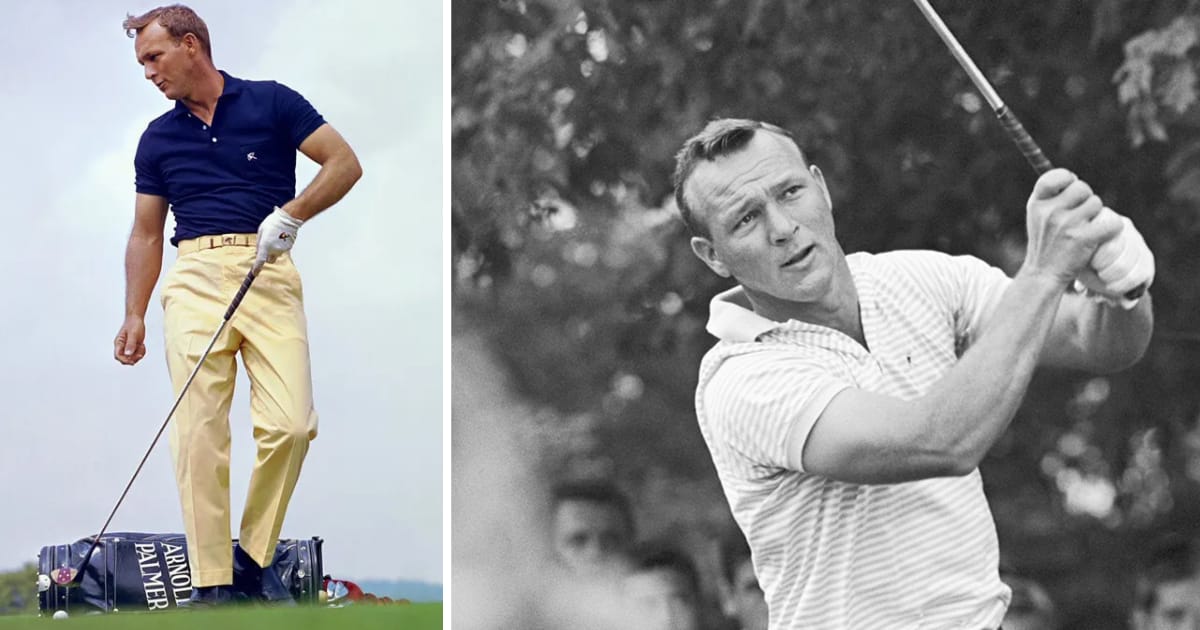

Pic from Mr Porter

On a handshake in 1960, golfer Arnold Palmer and attorney Mark McCormack created International Management Group (IMG) and invented modern sports marketing.

McCormack didn't just manage Palmer's golf career. He sold Palmer's authentic personality - his charisma, fearless style, working-class appeal to "Arnie's Army." He secured groundbreaking deals with Rolex, Pennzoil, and Cadillac, turning Palmer's umbrella logo into a licensable brand, most famously the Arnold Palmer drink.

Palmer earned roughly $7 million from tournament winnings but made at least 50 times that amount off the course.

This partnership established the template every modern athlete follows: treat the athlete as a corporation, diversify revenue beyond performance, leverage authenticity. By adding Nicklaus and Player to form "The Big Three," McCormack packaged golfers for global TV events that promoted the players, sport, and IMG itself.

Sixty-five years ago, a handshake transformed Palmer into the world's first true sports millionaire and proved that in golf, personal brand equity is the most valuable asset.

Next week

We look at why Nike failed to establish themselves as serious players in the golf equipment world, what went wrong and what lessons can we learn from their mistakes.

Have a good week. Until next Friday,

David

P.S. Got questions? Ideas? Just want to talk golf? Hit reply. We read every email.

P.P.S. If you missed last week’s newsletter, you can find it on our website.